Advertisements

Personal, property, and digital security has never been more important than it is today. In a hyperconnected world, with diverse and constantly evolving risks, having reliable protection has ceased to be a luxury and has become a basic necessity.

In this context, Loovi Seguros emerges as a leading player in the Brazilian insurance market, with an innovative, accessible, and 100% digital offering.

Advertisements

With a business model focused on simplicity, customization and agility, Loovi has won over thousands of customers looking for Tailor-made coverage, quick contracting, and personalized attention, all from your cell phone..

In this article, we'll explore the world of Loovi Seguros, its unique features, its solutions, and how it has established itself as a benchmark for innovation in the insurance sector.

Advertisements

New consumer behavior and digital insurance

In recent years, the consumer has changed. Today they look for autonomy, practicality and personalized servicesThis applies to transportation, food, entertainment… and also insurance.

Before, taking out insurance was a bureaucratic process, with reams of paperwork, complicated clauses, and slow service.

With the digital transformation, new insurtechs (technological startups in the insurance sector) emerged and Loovi is one of the main names of this new generation.

See also:

- Boost your cell phone with Turbo Battery

- Master judo like a champion now

- Recover your memories right now

- Discover your destination with our App

- Play violão like a pro!

Loovi was born with the purpose of Democratize access to personal and property protection in Brazil, offering an accessible, transparent and easy-to-use service.

Who is Loovi Seguros?

Loovi is a Brazilian digital insurer, created to simplify the insurance world and bring it closer to the reality of ordinary people.

Its focus is on offering Personalized and hassle-free protection, with flexible plans and 100% % online contracting, without intermediaries or long processes.

Loovi's great differential is in its monthly subscription model, where the user chooses what they want to protect (life, property, cell phone, credit card, digital identity, etc.), how much they want to pay, and which coverages are most important. All this is clear, straightforward, and without fine print.

Loovi's Mission and Values

Loovi's mission is protect people, not just their property, through technological solutions that make users' lives easier and provide peace of mind. Its core values are:

- Transparency: No technical jargon or surprises in the contract.

- SimplicityThe entire process, from registration to claim, is digital and fast.

- Accessibility: Plans with fair prices for different audiences.

- Empathy: Humanized and close attention, even being a digital company.

- Innovation: Technology at the service of the customer and prevention.

How does Loovi insurance work?

Loovi works with personalized plans, which can be purchased directly from its app or website.The customer chooses the type of protection they need and adjusts the monthly payment according to their profile.

Step by step to purchase Loovi insurance

- Download the app or access the website.

- Register with basic information.

- Perform a custom simulation.

- Choose the coverages that fit your routine.

- Confirm payment and activate insurance immediately.

- Monitor the policy and make requests from the app.

The whole process is intuitive and takes only a few minutes.

Coverages offered by Loovi

Loovi offers a wide variety of insurance and services adapted to the modern lifestyle, including digital protection and mobility.

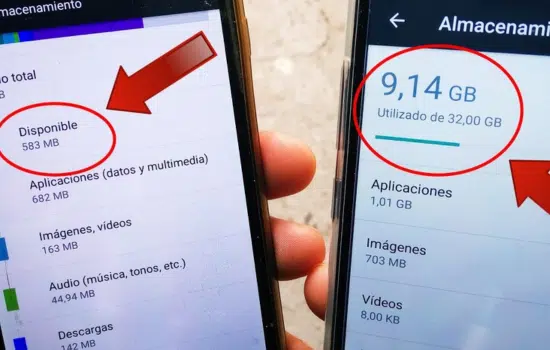

1. Insurance for cell phones and mobile devices

- Coverage for robbery and qualified theft.

- Protection against accidental damage.

- Assistance for equipment replacement.

- Technical support via the app.

2. Digital identity protection

- Monitoring CPF and personal data on the internet.

- Real-time alerts for leaks or fraud.

- Legal support in case of invasions.

- Assistance to recover your digital identity.

3. Life and personal accident insurance

- Coverage for natural or accidental death.

- Disability compensation.

- Funeral assistance and family support.

- Flexible and adjustable values.

4. Bank card protection

- Refund for unauthorized purchases.

- Immediate blocking assistance.

- Protection also for online purchases.

5. Home and family assistance

- 24-hour locksmith, plumbing, and electrical services.

- Discounts on home repairs.

- Immediate help in domestic emergencies.

These covers can can be contracted individually or in customized packages, depending on the client profile.

What differentiates Loovi from traditional insurers?

1. Hiring 100 % digital

No need to leave home or talk to a broker. Everything is done from your phone.

2. Affordable prices

Plans starting at R$ 5 per month, adjustable to any budget.

3. Cancellation without penalties

The customer can cancel or change their plan at any time, right from the app.

4. Humanized care

Although it is digital, the support is close, fast and efficient.

5. Total transparency

No fine print, no hidden charges, no surprises.

Technology for the customer

Loovi uses cutting-edge technology to enhance its users' experience:

- Artificial intelligence to customize coverage and analyze risks.

- Big data to detect fraud.

- Data encryption to protect information.

- Integration via API with other digital platforms.

All this allows for a efficient, secure management tailored to each client.

Testimonials from satisfied customers

More than a million Brazilians have already chosen Loovi. Here are some of their testimonials:

“I thought insurance was only for cars. With Loovi, I discovered I can protect my phone, my data, and even my family for very little money.”

— Juliana Souza, 28 years old

“I suffered an attempted fraud with my CPF, and Loovi alerted me before it happened. They helped me with everything. Very efficient.”

— Carlos Mendes, 34 years old

"I dropped my phone and broke the screen. I reported it through the app, and it was repaired within two days."

— Fernanda Lima, 22 years old

Expansion and social commitment

Loovi is growing rapidly throughout Brazil, reaching places where insurance is not yet common. It also carries out:

- Free financial education.

- Social projects on digital protection.

- Empowering youth in vulnerable communities.

Loovi not only sells insurance, but transforms people's relationship with their security and well-being.

Conclusion

Loovi Seguros represents the evolution of the insurance sector, with a digital, flexible, and accessible offering. If you're looking for modern, transparent, and bureaucratic insurance, Loovi is the ideal option.

Download the app, simulate your plan, and experience a new concept in protection. Because today, It's not enough to be lucky. You have to have love..